Registering under the MSME framework not only opens doors to these opportunities but also acts as a growth catalyst for startups and small business owners across the country.

Are you a startup founder or a small business owner trying to grow your venture in India? Then MSME registration could be one of the smartest moves you make in 2025.

Micro, Small, and Medium Enterprises (MSMEs) are the heartbeat of India's economic engine. MSMEs play a crucial role in shaping India's economy. They help drive new ideas, create jobs, and support communities across the country. As India moves towards becoming a stronger and more self-reliant economy, supporting these small and growing businesses has become more important than ever.

Registering your business under the Micro, Small, and Medium Enterprises (MSME) category not only gives it formal recognition but also unlocks a world of benefits—from government subsidies to priority in tenders, from easy loan approvals to legal protection. And the best part? It's free and hassle-free via the Udyam Registration Portal.

Let us break down the key MSME registration benefits for startups and small businesses, updated for 2025, in a simple and practical way.

MSME registration offers a structured path for startups and small enterprises to access government support and financing. Registering under the Udyam portal provides official recognition and unlocks numerous incentives that can help businesses scale faster with lower risk. Some of the primary reasons to register include:

With the latest policy reforms introduced in 2025, the scope and benefits of MSME registration have expanded even further.

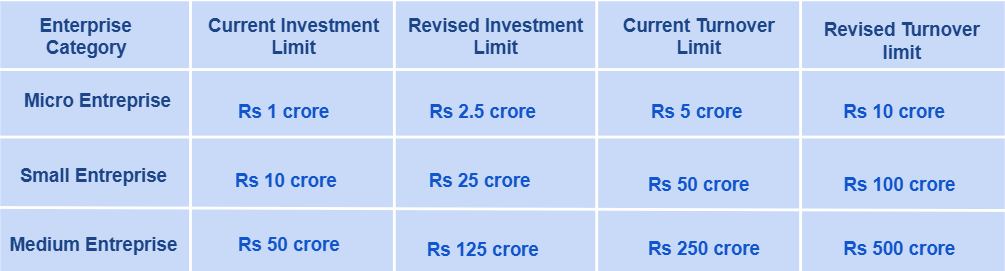

1. Revised Investment and Turnover Limits

To broaden the scope of eligible businesses, the government has revised the classification criteria for MSMEs in 2025. These relaxed norms allow more startups and growing businesses to qualify for MSME benefits without restructuring:

This inclusive classification supports scale-ups while ensuring they continue to enjoy regulatory and financial privileges.

2. Credit Guarantee Coverage Enhanced

The Credit Guarantee Scheme for MSMEs has been further strengthened in 2025. Now offering collateral-free credit up to ₹2 crore, the scheme covers a wider base of lenders and includes streamlined approval timelines. This gives entrepreneurs — especially those without fixed assets — access to working capital and growth funding.

The enhanced scheme also ensures that first-time entrepreneurs and women-led MSMEs receive prioritized support.

3. Schemes for First-Time Entrepreneurs

To build a culture of entrepreneurship, the government has revamped several schemes in 2025 that are specially tailored for new business owners:

These schemes make it easier for first-time business owners to start, sustain, and scale their operations.

4. Launch of the Deep Tech Fund of Funds

In an effort to strengthen India’s presence in emerging technologies, the Deep Tech Fund of Funds has been introduced in 2025. This ₹10,000 crore initiative supports startups and MSMEs working in sectors like artificial intelligence, quantum computing, robotics, and semiconductor design. The fund offers:

This initiative is a major step toward making India a global leader in high-tech innovation.

5. Export Promotion Mission for MSMEs

To improve global competitiveness, the government has rolled out the Export Promotion Mission focused on helping MSMEs tap international markets. This mission includes:

This mission is expected to boost MSME exports and integrate more Indian businesses into global value chains.

6. Credit Cards for Micro Enterprises: A tailored credit card scheme will offer micro enterprises registered on the Udyam portal up to ₹5 lakh in credit, with a target of issuing 10 lakh cards in the first year.

7. Other Noteworthy Benefits of MSME Registration

MSME registration is now simplified through the Udyam Registration Portal. The process is entirely paperless and Aadhaar-linked, and only PAN and GSTIN are required for validation. Upon registration, enterprises receive a unique Udyam Registration Number and certificate, which is valid for lifetime and auto-updated based on ITR and GST filings.

In 2025, MSME registration is no longer just a formal classification — it’s a strategic decision for any startup or small business looking to thrive in a competitive market. With access to capital, markets, innovation grants, and export opportunities, MSME status unlocks a host of advantages that can fast-track business growth.

Whether you're an emerging tech entrepreneur or a traditional manufacturer, registering as an MSME empowers you with financial tools, market visibility, and government-backed support.

At JKStartup360, we help you register your MSME hassle-free and also guide you to tap into the right schemes for your business needs.

Any business entity involved in manufacturing, production, or service activities can apply for MSME registration in India, provided it falls within the prescribed investment and turnover limits defined by the Government of India.

Yes, MSME-registered businesses in India enjoy several tax-related benefits, although there are no direct income tax exemptions solely for MSMEs. The advantages come through indirect tax reliefs, compliance relaxations, and access to government schemes that reduce the overall tax burden.

Yes, Udyam registration is the official and updated process for MSME registration in India. Introduced by the Ministry of Micro, Small and Medium Enterprises, Udyam Registration replaced the earlier system of MSME registration (Udyog Aadhaar) starting from July 1, 2020.

Namblabal Pampore

Near J&K Bank,

Jammu and Kashmir,192121

+91-7051410360

contact@jkstartup360.com

Ensure compliance and build trust by adhering to FSSAI regulations. JKStartup360 offers hassle-free registration for restaurants, food manufacturers, traders, and cloud kitchens to operate legally across India.

Starting a business? Company registration is the first step toward establishing a legal entity, and ensuring compliance with Indian business laws. Whether you're forming a Pvt Ltd Company, LLP, OPC, or Partnership Firm, we simplify the process for you.

Trademark registration protects your brand, granting exclusive rights and legal security. Whether you're a startup, small business, or enterprise, our experts ensure a fast, compliant Trademark filing process.

Income Tax Return filing is essential for compliance with Indian tax laws, enabling you to claim deductions and manage tax liabilities efficiently. At JKStartup360, our experts simplify Income Tax registration and tax filing, ensuring a quick, accurate, and hassle-free process.

GST registration is mandatory for businesses exceeding the turnover limit or engaged in interstate trade, e-commerce, or taxable supplies. Legally collect GST, claim input tax credit, and expand your business with our expert-guided, smooth, and efficient GST filing process.

Boost your business with JKStartup360’s digital marketing services. We specialize in SEO, social media, PPC, and content marketing to enhance brand visibility, lead generation, and customer engagement. Our result-driven strategies ensure maximum ROI and business growth.

Ready to Take Plan? It’s Just a Matter Of Click.

Try it Risk Free we Don’t Charge Cancellation Fees.